BichNgoc

-

Legal service

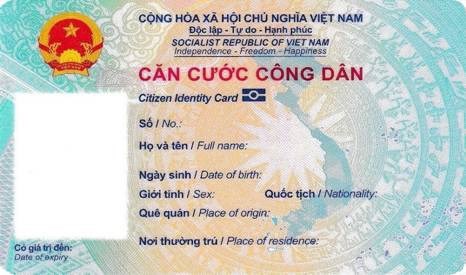

Documents to make citizen identification for temporary residents in Vietnam

According to the Law on Citizen Identification 2014, Vietnamese citizens aged full 14 years or older granted a citizen identity…

Xem thêm » -

Legal service

Number of times employees try jobs in Vietnam

Today, LSX Lawfirm will give you an article about: “Number of times employees try jobs in Vietnam”, as follows: Legal…

Xem thêm » -

Legal service

Can a car enter the truck lane in Vietnam?

Currently, many people participate in traffic but do not understand clearly about lanes. For example, cars allowed to enter the…

Xem thêm » -

Legal service

Truck lanes in Vietnam

Currently, vehicles when traveling on the road must follow the prescribed lane. In case you want to turn to another…

Xem thêm » -

Legal service

Employer’s management rights in Vietnam

A worker, employee, employee, craftsman or worker who is salaried, who contributes labor and expertise in an effort to produce…

Xem thêm » -

Legal service

Minimum amount of fire insurance in 2022 in Vietnam

Fire and explosion insurance is a type of insurance that compensates customers and businesses for loss or damage caused by…

Xem thêm » -

Legal service

Regulations on fire and explosion insurance in Vietnam

Decree 97/2021/ND-CP issued on November 8, 2021 amending Decree 23/2018/ND-CP dated February 23, 2018 on regulations on compulsory fire and…

Xem thêm » -

Legal service

Cases that cannot be arranged for resettlement in Vietnam

LSX Lawfirm will give you an article about: “Cases that cannot arrange for resettlement in Vietnam”, as follows: Legal grounds…

Xem thêm » -

Legal service

Temporary residence card for foreigners married to Vietnamese

Currently, the number of foreigners marrying Vietnamese citizens is increasing day by day. Therefore, the demand for temporary residence cards…

Xem thêm » -

Rights and obligations of seller in a contract of sale of goods in Vietnam

In a goods sale and purchase contract, besides the rights and obligations agreed upon by the seller and the buyer,…

Xem thêm »