Do individual business households need input invoices in Vietnam?

Input invoices, also known as purchase invoices, generate quite a lot and play an important role in the deductible tax of the business for businesses such as manufacturing, construction, distribution, etc. In addition to enterprises, business household appears a lot in the market today. So, do business households need to apply input invoices? In this article, LSX legal firm would like to answer the question: “Do individual business households need input invoices in Vietnam?”

Legal grounds

- Decree 01/2021/ND-CP

- Decree 125/2020/ND-CP

- Circular 78/2014/ND-CP

Business Household

Under the Vietnamese legislation, the household business means a type of business established by an individual or family household members that shall take responsibility for business operations of the household business with all of their property. If a household business is established by members of a family household, one of them shall be authorized to act as the representative of the household business. The individual applying for registration of household business or the person authorized by the family household members to act as the representative of the household business presents as the owner of the household business.

The law does not require households engaged in agriculture, forestry, aquaculture, salt production, street vendors, nomadic or seasonal businesspeople, and service providers earning low revenues to apply for the establishment of household businesses, except for conditional business lines. The provincial People’s Committees shall specify the low revenues applied within their provinces.

Input invoices

Input invoices are invoices that are used for the purpose of paying for services; or buying goods, supplies, raw materials …

According to the law, the types of input invoices:

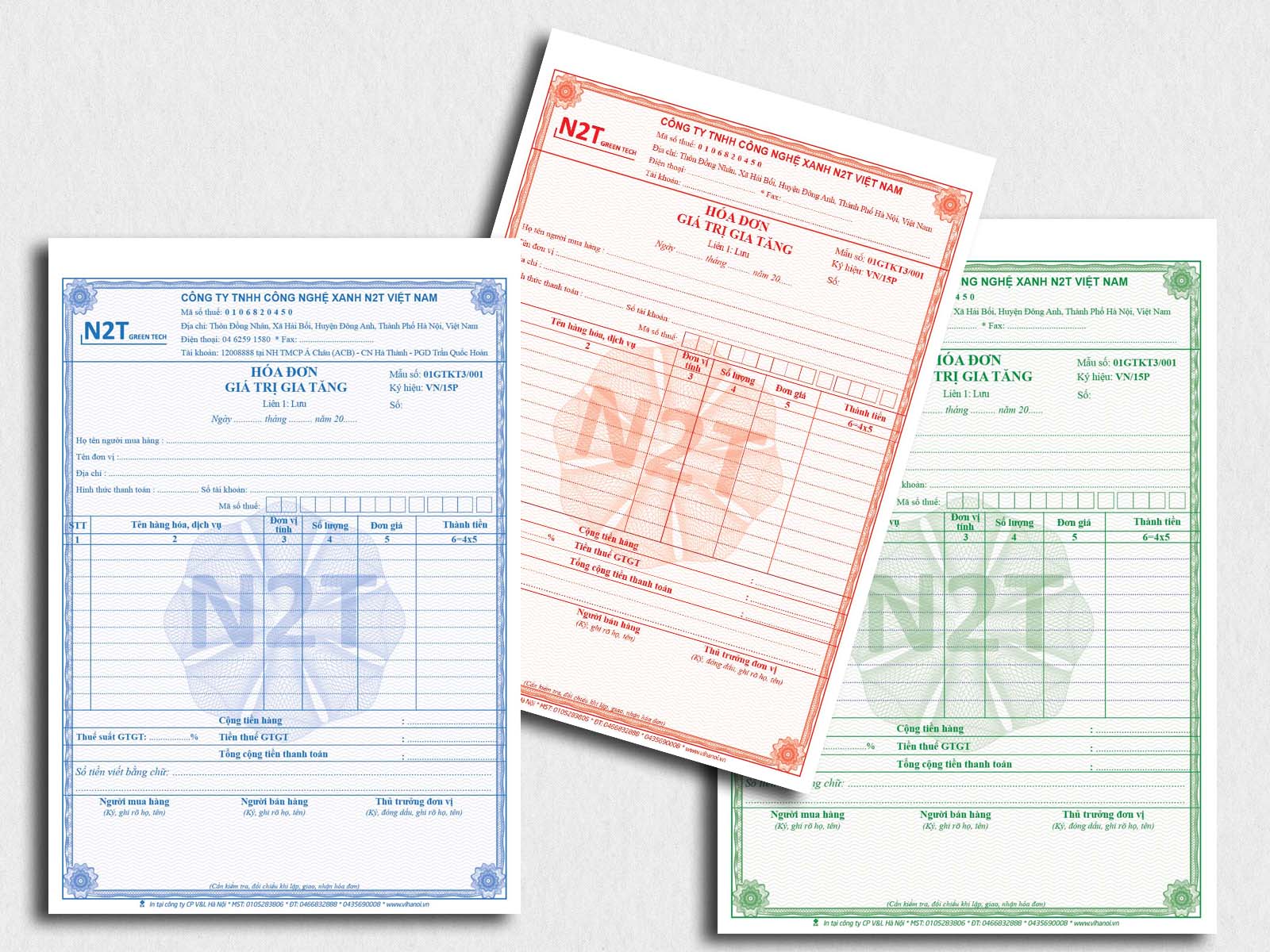

Value-added invoices

The type of invoice that the individual or organization when trading goods or providing services in the country; transportation activities at home and abroad, export; or export to a non-tariff zone declared according to the deduction method of value-added tax.

Sales Invoice

Type of invoice that individuals and organizations trade in goods; providing domestic and export services; or export into a non-tariff zone goods or services; goods trading in non-tariff zones shall declare and calculate value-added tax by the direct method.

Some other types of input invoices such as fee receipts, cash receipts, ticket cards, freight receipts, etc.

Do individual business households need input invoices?

Individual business households have the following characteristics: Small business scale; Input and output management according to personal experience, little application of technology software; Working-capital source, taking profit to turn investment; Not focusing on managing financial ratios.

Therefore, many business households often do not use input invoices when purchasing goods for accounting purposes. In fact, individual business households are only not allowed to issue sales invoices like business units. However, they still need to declare the input invoices.

Thus, input invoices do not restrict the type of invoices used when receiving goods and services for individual business households. Therefore, based on current legal regulations, depending on the case when receiving, and purchasing goods, business households can have input invoices. Individual business households must take input invoices to explain when selling goods and buying goods for business and trading activities with tax authorities.

Penalization when business households do not have input invoices

Clause 5, Article 24 of Decree 125/2020 ND-CP stipulates:

“Fines ranging from VND 10,000,000 to VND 20,000,000 shall be imposed for any act of failing to issue invoices upon sale of goods or provision of services to buyers as required by laws, except the acts prescribed in point b of clause 2 of this Article.”

Article 24. Penalties for violations against regulations on issuance of invoices upon sale of goods or provision of services

Fines ranging from VND 500,000 to VND 1,500,000 shall be imposed for one of the following violations:

b) Failing to invoice promotional, advertising, or sample goods or services; goods and services used as gifts, donations, presents, swaps, or employee’s payment-in-kind wages, except for internally circulated or consumed goods for further production purposes.

The case that individual business households do not need an input invoice

Based on Circular No. 78/2014/TT-BTC, there are two cases where business households do not need an input invoice to declare tax:

Goods and services in the product group that do not need an input invoice

- Individual business households will not need to get input invoices when buying products; goods of the following categories: agricultural products, aquatic products from sellers who catch directly, produce directly for sale, and breeders.

- Handicraft products made by hand from jute, sedge, bamboo, rattan, straw, leaves,…. or other materials used from agricultural products also do not need to get an invoice when buying.

- Products sold by artisans who do not conduct business directly, such as soil, stones, sand, and gravel exploited by individuals and households themselves without breaking the law.

- Directly sold resources such as scrap, utensils, property; or services sold directly by non-business individuals or households with a yearly turnover of less than VND 100 million (currently stipulated turnover rate starts generating value added tax) not require input invoice. Besides, in this case, individual business households must make a list of goods and service purchases.

When buying goods and services with an order value of less than 200,000 VND

When an individual business household purchases goods and services from another unit with a value of less than 200,000 VND, an input invoice is not required.

Legal service of LSX Legal Firm

LSX legal firm provides legal services to clients in various legal areas. To make your case convenient, LSX will perform:

- Legal advice related to new regulations;

- Representing in drafting and editing documents;

- We commit the papers to be valid, and legal for use in all cases;

- Represent to submit documents, receive results, and hand them over to customers.

With a team of experienced, reputable, and professional consultants; The firm is always ready to support and work with clients to solve legal difficulties.

Furthermore, using our service, you do not need to do the paperwork yourself; We guarantee to help you prepare documents effectively and legally.

Also, you will not have to waste time preparing the application, submitting application, or receiving results. At those stages, we will help you do it smoothly.

After all, LSX provides the service with the desire that customers can experience it the best way. Additionally, we guarantee the cost to be the most suitable and economical for customers.

Contact LSX

Finally, hope this article is useful for you to answer the question about “Do individual business households need input invoices in Vietnam?”. If you need any further information, please contact LSX Law firm: +84846175333 or Email: [email protected]

Related articles

- How to buy voluntary health insurance in Vietnam while pregnant?

- Duties and powers of the competent authorities in tax administration in Viet Nam

- Why pay personal income tax in Vietnam?

Related questions

Goods and services subject to VAT are those used for production, trading, and consumption in Vietnam (including those purchased from overseas organizations and individuals), except for the goods and services in Article 4 of Circular 219/2013/TT-BTC.

When a business household shuts down its operation, it must send a notification and return the original certificate of business household registration to the business registration authority of the district where the business household was registered, settle all outstanding debts, including tax debts, and financial obligations.

The current law does not limit the number of business lines that a business household can register. Business households can register many industries and occupations. However, they must have the approval of the business registration authority for those business lines. This means that a household must satisfy the following conditions:

– Registered business lines not prohibited by law;

– Having the conditions to do business in that line (meaning that the business needs to apply for a sub-license, the business household must carry out procedures for the issuance of a license).

Conclusion: So the above is Do individual business households need input invoices in Vietnam?. Hopefully with this article can help you in life, please always follow and read our good articles on the website: lsxlawfirm.com