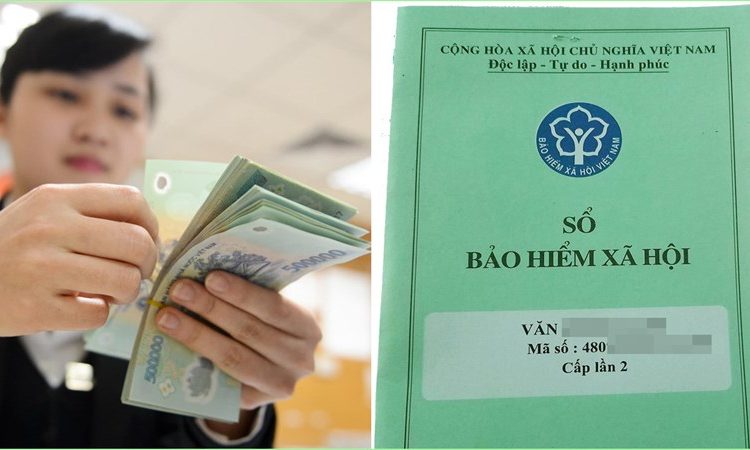

Regulations on voluntary social insurance rates in Vietnam 2022

Voluntary social insurance attracts a lot of attention from people with various income levels. Some people do not know the reasonable rate to pay for this kind of insurance. So, in this article, LSX legal firm would like to inform you with: “Regulations on voluntary social insurance rates in Vietnam 2022”

Legal ground

- Law on Social Insurance 2014

Voluntary Social Insurance

Voluntary social insurance is a type of insurance organized by the State in which participants can choose a payment level and payment method that is suitable to their income. Participants of voluntary social insurance in 2022 will enjoy 02 regimes, including death and pension insurance.

Voluntary social insurance rates mean the minimum and maximum amount that the social insurance participant voluntarily chooses to pay social insurance premiums to suit the insured’s economy when they meet the conditions to pay voluntary social insurance.

Who has the right to participate in voluntary social insurance?

According to Clause 4, Article 2 of the Law on Social Insurance 2014, voluntary social insurance participants are Vietnamese citizens aged full 15 years and older and are not subject to compulsory social insurance participation.

Besides, Clause 1, Article 8 of Decision 595/QD-BHXH also specifically lists the subjects eligible to participate in voluntary social insurance today, including:

- Employees working under contracts whose term is under 3 months (before January 01, 2018) and employees working under contracts whose term is under 1 month (from January 01, 2018, onwards);

- Part-time officials of villages, hamlets, squires, street groups, and quarters;

- Domestic servants;

- Employees engaged in activities of production, business, and service without salary;

- Employees working for cooperatives without salary;

- Farmers and self-employed people include people who organize activities themselves to earn income for themselves and their families;

- Employees who have reached the statutory retirement age but fail to satisfy the condition for the payment period to receive pensions as prescribed by regulations of law on social insurance;

- Other participants.

Voluntary social insurance levels

- Employees shall monthly pay an amount equivalent to 22% of their monthly incomes as selected to the retirement and survivor allowance fund.

- The monthly income on which social insurance premiums are based must at least be equal to the poverty threshold in rural areas and must not exceed 20 times the basic salary.

- Determination of the levels of support for payment of social insurance premiums for employees covered by voluntary social insurance, support beneficiaries, and the time for implementing the support policy based on the socio-economic development conditions and state budget capacity in each period.

Payment methods

A participant in voluntary social insurance shall choose one of the following methods for making a payment to the retirement and death benefit funds:

- Monthly payment

- Quarterly payment

- Biannual payment

- Annual payment

- Lump sum payment for multiple years but not exceeding 5 years per payment;

- Lump sum payment for the remaining years shall apply to the participant in social insurance who has reached the statutory retirement age but his/her payment period of social insurance contributions lacks 10 years or less (120 months). This participant is allowed to pay social insurance contributions for 20 years to receive his/her pension.

Change of payment methods of voluntary social insurance

- Participants in voluntary social insurance can change payment methods when completing the previously chosen method.

- If a participant in voluntary special insurance who has chosen one of the methods prescribed above is eligible for making a lump sum payment for the remaining years (a man shall be 60 years old and a woman shall be 55 years old and the remaining period is 10 years or less), he/she will be allowed to make a lump sum payment as soon as eligible and the chosen method is not required to be completed.

Suspension from payment of compulsory social insurance premiums

Under article 88 of the Law on Social Insurance 2014:

- Suspension from payment to the retirement and survivor allowance fund is specified as follows:

a/ In case employers meet with difficulties and have to suspend their production or business activities, making them and their employees unable to pay social insurance premiums, the payment to the retirement and survivor allowance fund may be suspended for 12 months at most;

b/ Upon the expiration of the time limit for payment suspension specified at Point a of this Clause, employers and employees shall continue paying social insurance premiums and make supplementary payments for the suspension period. The supplementary amount paid for the suspension period is not subject to late payment interest under Clause 3, Article 122 of this Law. - For employees covered by compulsory social insurance premiums who are put in temporary detention, they and their employers may suspend the payment of social insurance premiums. In case competent agencies conclude that employees suffer a miscarriage of justice, supplementary payment shall be made for the detention period. The supplementary amount paid for the suspension period is not subject to late-payment interest under Clause 3, Article 122 of this Law.

- The Government shall detail this Article and specify other cases of suspension from payment of compulsory social insurance premiums

Legal service of LSX Legal Firm

LSX legal firm provides legal services to clients in various legal areas. To make your case convenient, LSX will perform:

- Legal advice related to new regulations;

- Representing in drafting and editing documents;

- We commit the papers to be valid, and legal for use in all cases;

- Represent to submit documents, receive results, and hand them over to customers.

With a team of experienced, reputable, and professional consultants; The firm is always ready to support and work with clients to solve legal difficulties.

Furthermore, using our service, you do not need to do the paperwork yourself; We guarantee to help you prepare documents effectively and legally.

Also, you will not have to waste time preparing the application, submitting application, or receiving results. At those stages, we will help you do it smoothly.

After all, LSX provides the service with the desire that customers can experience it the best way. Additionally, we guarantee the cost to be the most suitable and economical for customers.

Contact LSX

Finally, hope this article is useful for you to answer the question about “Regulations on voluntary social insurance rates in Vietnam 2022”. If you need any further information, please contact LSX Law firm: +84846175333 or Email: [email protected]

Related articles

Conditions for business suspension of joint-stock company in Vietnam

Certificate of business suspension of business in Vietnam

Conditions for business suspension of business in Vietnam

Related questions

Conditions for participation in voluntary social insurance: belong to the subjects of Clause 1, Article 8 of Decision 595/QD-BHXH and not subject to compulsory social insurance participation in accordance with the law on social insurance.

1: Prepare and submit an application.

2: Pay for voluntary social insurance.

3: The social insurance agency receives the dossier and settles it according to regulations.

4: Get the result.

Mdt = 22% x Mtnt

Where:

Mdt: the monthly contribution paid by a participant in voluntary social insurance

Mtnt: the monthly income chosen by the participant

Mtnt = CN + m x 50.000 (VND per month)

Where:

CN: Poverty line in rural areas at the time of payment (VND per month).

m: the parameter whose value is from 0 to n.

The monthly income chosen by the participant in voluntary social insurance shall at least equal the poverty line in rural areas monthly and not exceed 20 times the statutory pay rate.

Conclusion: So the above is Regulations on voluntary social insurance rates in Vietnam 2022. Hopefully with this article can help you in life, please always follow and read our good articles on the website: lsxlawfirm.com