Can Vietnamese bank employees disclose customer information?

Nowadays, private information such as name, home address, email, phone number… is becoming more valuable than ever. The disclosure of this information greatly affects the lives of many people, especially in the relationship between customers and banks, and credit institutions. So can bank staff disclose customer information? To better understand this, today, LSX Lawfirm will give you an article about “Can Vietnamese bank employees disclose customer information?“, as follows:

Legal grounds

- Decree 117/2018/ND-CP;

- Penal Code 2015 was amended and supplemented in 2017;

- Decree 88/2019/ND-CP.

Can bank employees disclose customer information?

At banks, there are some employees who have the right to access customer accounts to check and review information for business and professional activities. However, it is the responsibility of the bank staff and the bank itself to keep customer information secure.

Bank employees who disclose customer information can be fired

Confidentiality of customer information is one of the most important principles in the operation of credit institutions and banks. Specifically, Clause 1, Article 4 of Decree 117/2018/ND-CP states:

Customer information of credit institutions and foreign bank branches must be kept confidential and provided only in accordance with the provisions of the 2010 Law on Credit Institutions, as amended and supplemented in 2017, this Decree. and relevant legislation.

In particular, banks are only allowed to provide information in the following cases:

Customer requested, the customer agreed, customer allowed;

At the request of state authorities, legal agencies (courts, police, tax authorities,…);

Serves for internal operations.

Individuals who violate the principle of confidentiality of customer information by illegally disclosing and disclosing information will be subject to disciplinary measures from the credit institution from a reprimand to termination of labor contract and termination of employment. compensation, if any.

In addition, depending on the severity of the violation, the performer may be administratively sanctioned or even prosecuted for criminal liability.

Disclosure of bank information is subject to an administrative fine of up to VND 40 million

In Clause 4, Article 47 of Decree 88/2019/ND-CP on sanctioning of administrative violations in the field of currency and banking, it is stipulated that:

- A fine ranging from VND 30,000,000 to VND 40,000,000 shall be imposed for one of the following violations:

a) Making untruthful reports;

b) Providing information related to the operation of the State Bank, credit institutions, foreign bank branches, customer information of credit institutions, and foreign bank branches in contravention of regulations; provisions of law;

c) Failing to provide information, records, and documents as prescribed by law;

d) Leaking or using customer information of credit institutions or foreign bank branches for improper purposes as prescribed by law.

According to the above regulations, if they voluntarily provide or disclose customer information to the outside, the executor may be subject to an administrative fine of up to VND 40 million.

Unauthorized disclosure and exchange of bank account information can lead to jail time

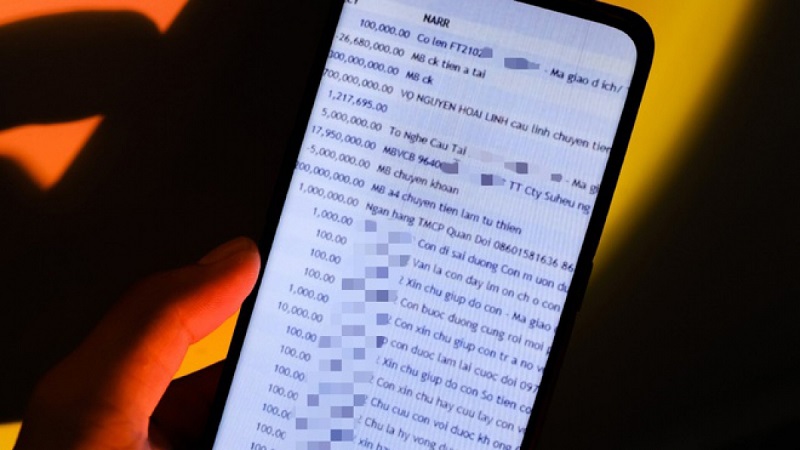

Bank account information is extremely important information and must be absolutely confidential. Illegally exchanging, buying, selling, and disclosing information about bank accounts not only violates the banking industry’s operating principles but also contains many potential financial dangers for people who lose information.

If illegally exchanging or disclosing bank account information of many people, or illegally profiting from 20 million VND or more, the performer may be prosecuted for criminal liability for the crime of collecting, possessing, exchanging Illegally exchanging, buying, selling, or disclosing information about bank accounts specified in Article 291 of the Penal Code 2015 as amended and supplemented in 2017, specifically:

- Those who illegally collect, store, exchange, buy, sell or publicize information about other people’s bank accounts with the number from 20 accounts to less than 50 accounts or illegally profit from 20,000 000 VND to less than 50,000,000 VND, the offenders shall be subject to a fine of from 20,000,000 VND to 100,000,000 VND or a non-custodial reform for up to 3 years.

- Committing the crime in one of the following circumstances, the offenders shall be subject to a fine of between VND 100,000,000 and 200,000,000 or a prison term of between 3 months and 2 years:

In addition

a) Illegally collecting, storing, exchanging, trading, or disclosing information about other people’s bank accounts from 50 accounts to less than 200 accounts;

b) Organized;

c) Be of a professional nature;

d) Gaining illicit profits from VND 50,000,000 to under VND 200,000,000;

d) Dangerous recidivism.

- Committing the crime in one of the following circumstances, the offenders shall be subject. To a fine of between VND 200,000,000 and 500,000,000 or a prison term of between 02 and 07 years:

a) Illegally collecting, storing, exchanging, trading, or disclosing information about other people’s bank accounts. With the number of 200 accounts or more;

b) Gaining illicit profits of VND 200,000,000 or more.

- The offenders may also be subject to a fine of from VND 10,000,000 to VND 50,000,000, a ban from holding certain posts, practicing certain professions or doing certain jobs for 1 to 5 years, or having part or all of the work confiscated. property set.

Thus, if being examined for penal liability for the crime of illegally collecting, storing, exchanging, trading, or disclosing information about bank accounts, depending on the seriousness of the violation, the offenders may be prosecuted. punishable by up to 7 years in prison.

The role of the law in ensuring the confidentiality of customer information in banking activities

The security of customer information in banking is a very complicated issue. Because it concerns the interests of customers, the obligations of credit institutions, and third parties who want to continue to operate. Access that information to meet their purposes. Therefore, the banking law must be a means for the state to harmonize the interests of related entities, ensuring the harmonious and stable development of society. The law on confidentiality of customer information in the operating system must perform the following roles:

Firstly, to recognize and protect the privacy of customers in the financial sector

When a banking customer opens an account at a credit institution. The credit institution begins to receive and process information related to the customer. Such information reflects many aspects of a customer’s personal life. For example, the bank knows information related to the customer’s occupation. Age, marital status, consumption habits, etc., other information such as business plan, sales volume, relationship business relationships with partners. Business results of customers, other valuable data, figures, and information about trade secrets… These are very important, sensitive, and valuable information. harmful gas to competitors in the mining business.

Normally, confidential information of individual customers and institutional customers is kept confidential by credit institutions with the same legal provisions. However, in some cases, the private financial information of customers is personal, sensitive, and vulnerable, and deserves more special protection by law. Therefore, the banking law needs to have separate regulations on the confidentiality of information of individual customers and institutional customers.

Secondly, promote the bank’s business efficiency

Information related to customers is collected and kept by credit institutions to serve their business activities. Credit institutions cannot operate effectively without complete customer information, which is used in many aspects of their business operations.

Firstly, the information is used to directly serve the business activities of the credit institution. For example, to provide savings services, credit institutions need to know the name. Address, and other identifying information of the customer.

Second, customer information is consulted by credit institutions to avoid operational risks and credit risks. That is, credit institutions need to be able to analyze information about the credit history of credit applicants. In order to reduce the risk of overdue debt and effectively collect debts.

Third, customer information is used by credit institutions to promote and market certain financial products easily, quickly, and cost-effectively. This is a reasonable measure for credit institutions to survive in this highly competitive time.

Thus, the law on customer information security also needs to have provisions to ensure that there is no pressure related to the obligation to protect customer information, thereby weakening the competitiveness of credit institutions.

Thirdly, judicial assistance and law enforcement

Judicial activities and law enforcement in many cases will not be possible if credit institutions keep their customer information confidential. Therefore, the current world trend is to limit the scope of customer information security and use as much financial information to serve judicial activities and law enforcement. The provision of customer information, in this case, aims to:

Firstly, in legal proceedings, credit institutions may be obliged to provide customer information to assist in resolving legal issues related to inheritance and divorce, and to provide evidence for settlement in court. Bankruptcy proceedings or providing evidence in criminal proceedings… This is done due to the special position of credit institutions in the role of intermediaries in business transactions as well as in the daily lives of individuals. Almost all activities are reflected, more or less, in the information collected by credit institutions to serve their professional activities.

And

Secondly, in recent years, the crime situation in the banking sector is increasing, and the level of violations is particularly serious and sophisticated. For example, by taking advantage of regulations on customer information security. Criminals have transferred illegal funds derived from drug trafficking and terrorist financing. Illegal arms sales, and so on. , tax evasion … into the financial system to turn that money into legality. And from those “cleaned” funds, continue to provide criminals with drug trafficking, terrorism … Or manipulate the background national economy with “clean hands.”

Thirdly, regulators also need banking information for effective supervision in some areas. For example, monitoring insider transactions or monitoring through the information and reporting system in order to prevent, detect, prevent. And promptly handle risks that cause insecurity of banking operations, violations of security regulations, etc. The entire BCC and other relevant laws.

Therefore, the legal regulations on customer information security in the transaction should have clear and specific provisions on the right to request to provide or access customer information.

Fourthly, international cooperation in the prevention of transnational crime

The legal provisions on the obligation to keep customer information confidential in the ACT are very different in different jurisdictions. For example, under Swiss law, the confidentiality of customer information is strictly protected, even subject to imprisonment1. But in some other jurisdictions, for example, the United States. The confidentiality of customer information is interfered with and scrutinized by the government.

The current era of globalization and liberalization of financial markets has created favorable conditions. For international organized crime groups to use foreign banking secrets. To hide assets and proceeds. be illegal or to avoid tax obligations.

At the same time, the digital era with electronic payment systems is also a big challenge. For the tax management of countries. These illegal activities can only be prevented, limited, or controlled through international cooperation and assistance between law enforcement agencies.

Therefore, sharing information for the purpose of monitoring and preventing transnational crimes is a necessary requirement of state management agencies in countries. Therefore, an effective legal mechanism for protecting customer information needs to be able to strengthen international cooperation to combat transnational crime.

Fifthly, protect national sovereignty over the information of banking organizations

In addition to the need for international cooperation, the security of customer information in banking activities is also related to national sovereignty. In some cases, the national interest may require strict adherence to the confidentiality of information by credit institutions. For example, under the constant efforts of the Extraterritorial Principle (Extraterritorial Principle2 – The right or prerogative of a state to exercise its authority beyond territorial limits in certain cases) mainly the United States. States, national sovereignty over banking information located within national territory may present risks.

Therefore, the law on customer information security in the banking system needs to meet the requirements of protecting the sovereignty and control of banking information under the exclusive jurisdiction of the country.

Consulting service of LSX Lawfirm

Above is LSX Lawfirm’s advice on the content of the problem. “Can Vietnamese bank employees disclose customer information?”. And all the above knowledge to use in work and life. If you have any questions and need more advice and help, please contact the hotline for reception. Lawyer X is a place that provides reputable and fast business services at reasonable prices. Customers will be extremely satisfied when using our services.

- FB: www.facebook.com/luatsux

- Tiktok: https://www.tiktok.com/@luatsux

- Youtube: https://www.youtube.com/Luatsux

Related article

- Services that Vietnamese law firms provide to clients

- What is the Vietnamese law on working time after training?

- Can a wife authorize her husband to get a bank loan in Vietnam?

Related questions

Personal information is information sufficient to accurately identify an individual, including at least the following: full name, date of birth, occupation, title, contact address, address only email, phone number, identity card number, and passport number. Confidential information includes medical records, tax records, social security card numbers, credit card numbers, and other personal secrets then.

For individual customers: full name, signature form, electronic signature, date, month, year of birth, nationality, occupation, registered address of permanent residence, current residence, registered address registration of residence abroad for foreigners, phone number, email address, number, date of issue, place of issue of identity card or citizen identification card or passport (visa information for individual customers are foreigners) of the customer or the legal representative or authorized representative (collectively referred to as the legal representative) and other relevant information.

Personal information, after being accessed by the enterprise, can become the most commercially valuable data source through communication, promotion, marketing, and competitive activities in the market. Therefore, businesses want to capture, collect, use, analyze and exploit the Personal Information of current and potential customers. However, on the other hand, in order to ensure privacy, and the necessary freedom in daily life, in general, individuals do not want their Personal Information to be exposed, to the hands of others. that the person with personal information does not know what purpose they will use the information. In other words, each individual very much does not want his or her Personal Information to fall into the hands of strangers. Therefore, each individual often has a need to control (or seek to control) the spread of Personal Information relating to himself.

Contact LSX Lawfirm

Finally, hope this article is useful for you; answer the question: “ Can Vietnamese bank employees disclose customer information?”. If you need more information, please contact LSX Law firm: at +84846175333 or Email: [email protected].

Conclusion: So the above is Can Vietnamese bank employees disclose customer information?. Hopefully with this article can help you in life, please always follow and read our good articles on the website: lsxlawfirm.com