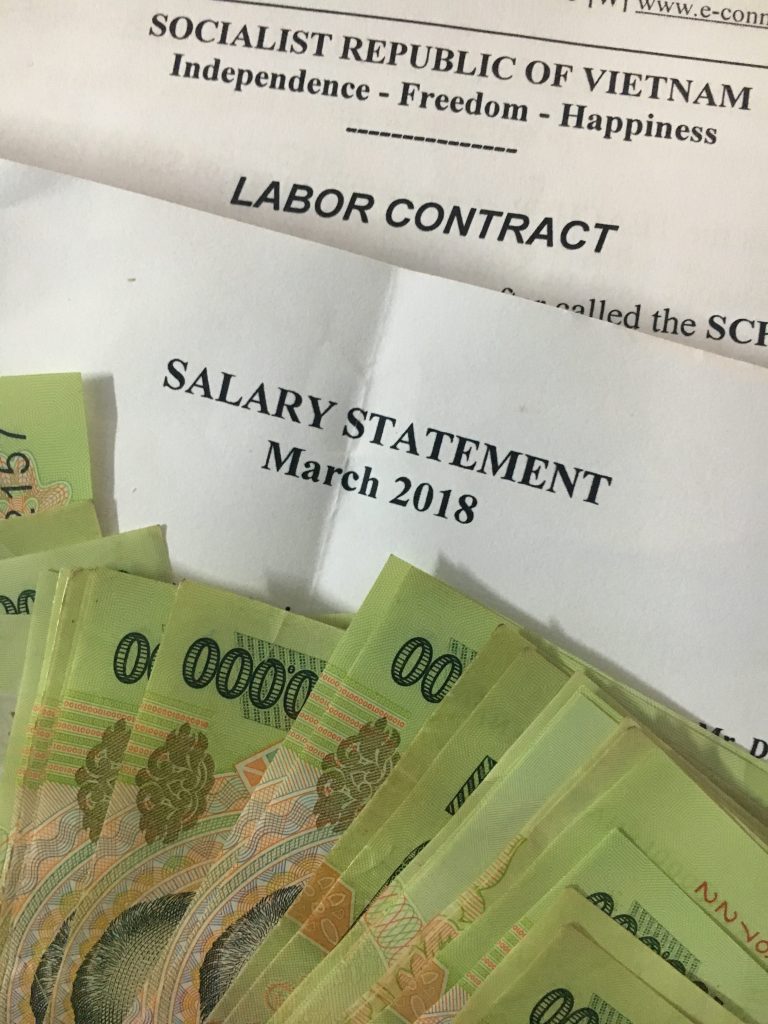

Proof of money transfer from abroad to Vietnam

Today, LSX Lawfirm will give you an article about: “Proof of money transfer from abroad to Vietnam”, as follows:

Legal grounds

Ordinance on Foreign Exchange 2005 (with 2013 Amendments and Supplements)

Decree 70/2014 / ND-CP regulating the Ordinance on Foreign Exchange and amending the Ordinance on Foreign Exchange

Circular No. 186/2010 / TT-BTC supporting the transfer of profits abroad

Investment Law 2014

Proof of money transfer from abroad to Vietnam

Article 8 Ordinance on Foreign Exchange 2005

Accordingly, Foreign currency received by organizations residing in Vietnam from unilateral money transfer must be transferred to foreign currency accounts opened at authorized lending institutions or sold to authorized lending institutions.

Foreign currency received by Vietnamese residents as a result of one-way money transfer shall be used to hold, carry or transfer to a foreign currency account opened at an authorized credit institution or sold to an authorized credit institution. ; If you are a Vietnamese citizen, you can save money in foreign currency at an authorized lending institution.

So, residents have the right to buy, transfer and export foreign currency abroad to serve their legitimate needs.

Non-residents, resident foreigners with foreign currencies on accounts remitted abroad; If they have a legitimate source of income in Vietnam Dong, they can buy foreign currency to transfer abroad.

Article 7 Decree 70/2014 / ND-CP

So Residents being organizations are entitled to one-way remittance abroad for sponsorship, assistance or other purposes as prescribed by the State Bank of Vietnam.

Residents being Vietnamese citizens may purchase, transfer and import foreign currencies abroad according to regulations of the State Bank of Vietnam for the following purposes:

a) study and treatment abroad;

b) So, Going on a business trip, tourism or visiting foreign countries;

c) Pay all kinds of fees and charges to foreign countries;

d) So, benefits for relatives living abroad;

dd) Transfer of inheritance money to heirs abroad;

e) Remittance in case of residing abroad;

g) Unilaterally transfer money for other lawful needs.

So, Non-residents, residents being foreigners who have foreign currency on their accounts or lawful foreign exchange revenue, transfer, export abroad; If they have a legitimate source of income in Vietnam dong; they can buy foreign currency to transfer or export abroad.

Authorized credit institutions are responsible for reviewing documents and papers submitted by residents and non-residents for sale, transfer; and certification of foreign currency sources that they own; or buy from credit institutions. allowed to be exported abroad; based on reality. and the reasonable requirements of each of them. money transfer service.

Article 11 Investment Law No. 67/2014 / QH13

November 26, 2014 provides: “After fulfilling financial obligations to the State of Vietnam; according to the provisions of law, foreign investors are allowed to transfer the following assets abroad:

Investment capital, liquidation of investments;

Income from economic activities and investment;

Money and other assets lawfully owned by the investor.

Conclude

Thus, foreigners can transfer the money they legally earn in Vietnam abroad. In accordance with the provisions of the Ordinance on Foreign Exchange and the Ordinance on Adjusting the Ordinance: if a foreigner is a resident or non-resident and has foreign currency in his account; he/she can directly transfer abroad. Vietnamese Dong can buy foreign currency. to move abroad. This money transfer must be done through credit institutions in Vietnam; and these credit institutions are responsible for verifying documents and papers provided by foreigners to confirm the source of foreign currency is legal.

To be able to transfer money abroad; the person who wants to transfer money must prove that the source of money; they want to transfer has a lawful source of income if that income is in Vietnam Dong. In the case you give; this foreigner buys a house in Vietnam and then resells it, so there are 2 cases: maybe this person does real estate business; or just buys and sells for ordinary people. However, in all cases, this person also needs to submit all documents confirming the legitimacy of the transaction.

In addition

If this foreigner is a foreign investor; the fact that they have the right to transfer profits after fulfilling financial obligations to the state such as paying personal income tax, corporate income tax, etc. repatriate profits; and at the same time have to pay money transfer fee credit institutions providing services. The law does not provide for tax exemption for the first house sold according to the provisions of Clause 1, Article 4 of Circular 186/2010 / TT-BTC:

Accordingly, the provisions of Clause 1, Article 4 of Circular No. 186/2010/TT-BTC dated November 18, 2010 of the Ministry of Finance so, “Foreign investors have the right to transfer profits distributed annually or received from the operation of foreign investor direct investment in Vietnam abroad at the end of the fiscal year from the date the enterprise has foreign investors participate. So, the investor has fulfilled its financial obligations to the State of Vietnam; in accordance with the law, submitted the audited financial statements and the corporate income tax finalization declaration for the fiscal year in accordance with regulations. provisions of the law.

Related questions

Foreign currency received by Vietnamese residents as a result of one-way money transfer shall be used to hold, carry or transfer to a foreign currency account opened at an authorized credit institution or sold to an authorized credit institution. ; If you are a Vietnamese citizen, you can save money in foreign currency at an authorized lending institution.

Accordingly, the provisions of Clause 1, Article 4 of Circular No. 186/2010/TT-BTC dated November 18, 2010 of the Ministry of Finance so, “Foreign investors have the right to transfer profits distributed annually or received from the operation of foreign investor direct investment in Vietnam abroad at the end of the fiscal year from the date the enterprise has foreign investors participate. So, the investor has fulfilled its financial obligations to the State of Vietnam

Contact LSX Lawfirm

Finally, hope this article is useful for you to answer the question about: “Proof of money transfer from abroad to Vietnam”. If you need any further information, please contact LSX Law firm : +84846175333 or Email: [email protected]

Conclusion: So the above is Proof of money transfer from abroad to Vietnam. Hopefully with this article can help you in life, please always follow and read our good articles on the website: lsxlawfirm.com